On March 12, 2019 the voters within the City of Fort Smith will decide on a one cent sales tax which will fund the completion of the United States Marshal’s Museum.

If the tax passes, non-residents, or anyone living outside the City of Fort Smith will be funding half the project. For every $100 spent, $1 will go towards the museum.

According to the U.S. Marshal’s Museum website, “Fort Smith is unique in that many people come into the city each day from a very large geographic

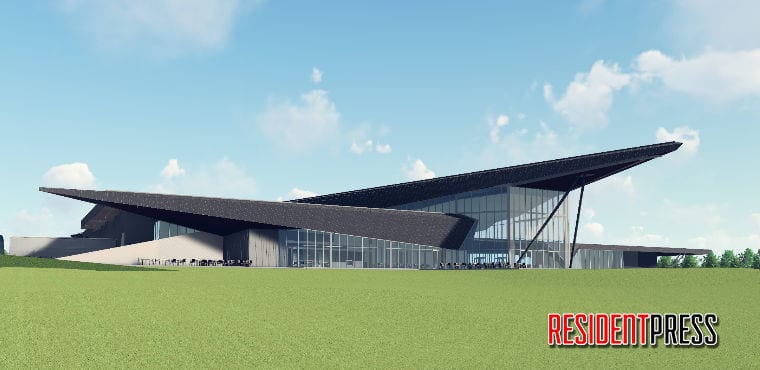

The tax, according to museum officials, will be short lived and will not be extended past it’s proposed nine months. The United States Marshal’s Museum Foundation is footing the bill for the cost of the March special election. Members of that foundation are seeking $15-16 million in additional funds to complete the project, which is already under way.

The initial announcement for the museum came in July of 2018. According to that news release, the projects projected total was $50 million. “Funding for the USMM project remains a top priority with $17.8 million remaining to fully fund the project.”

Fort Smith attorney and founder of transparency in government, Joey McCutcheon along with the committee of Citizens Against Unfair Taxation are calling the project a white elephant. “This project could become a white elephant just like the River Valley Sports Complex and Fort Smith

McCutcheon said he wants people to be educated about this proposal. “They are holding a gun to the taxpayers head by saying there is no plan B,” he added. “But if you want to buy a $200k home and can only afford $100k, then you would buy the one you could afford and live within your means.”

McCutcheon added that he believes the foundation members “should do their jobs and raise the money for the project.”