Beginning at 12:01 a.m. on Saturday, August 7, 2021, and ending at 11:59 p.m. on Sunday, August 8, 2021, the State of Arkansas will hold its sales tax holiday allowing shoppers the opportunity to purchase certain electronic devices, school supplies, school art supplies, school instructional materials, and clothing free of state and local sales or use tax.

All retailers are required to participate and may not charge tax on items that are legally tax-exempt during the Sales Tax Holiday.

1.) What is the Sales Tax Holiday?

Act 757 of 2011 provides for a sales tax holiday in Arkansas during the first weekend of August

each year. A sales tax holiday is a temporary period when state and local sales taxes are not

collected or paid on the purchase of certain products.

2.) When is the Sales Tax Holiday?

The Sales Tax Holiday will begin annually at 12:01 a.m. on the first Saturday in August and

conclude at 11:59 p.m. the following Sunday.

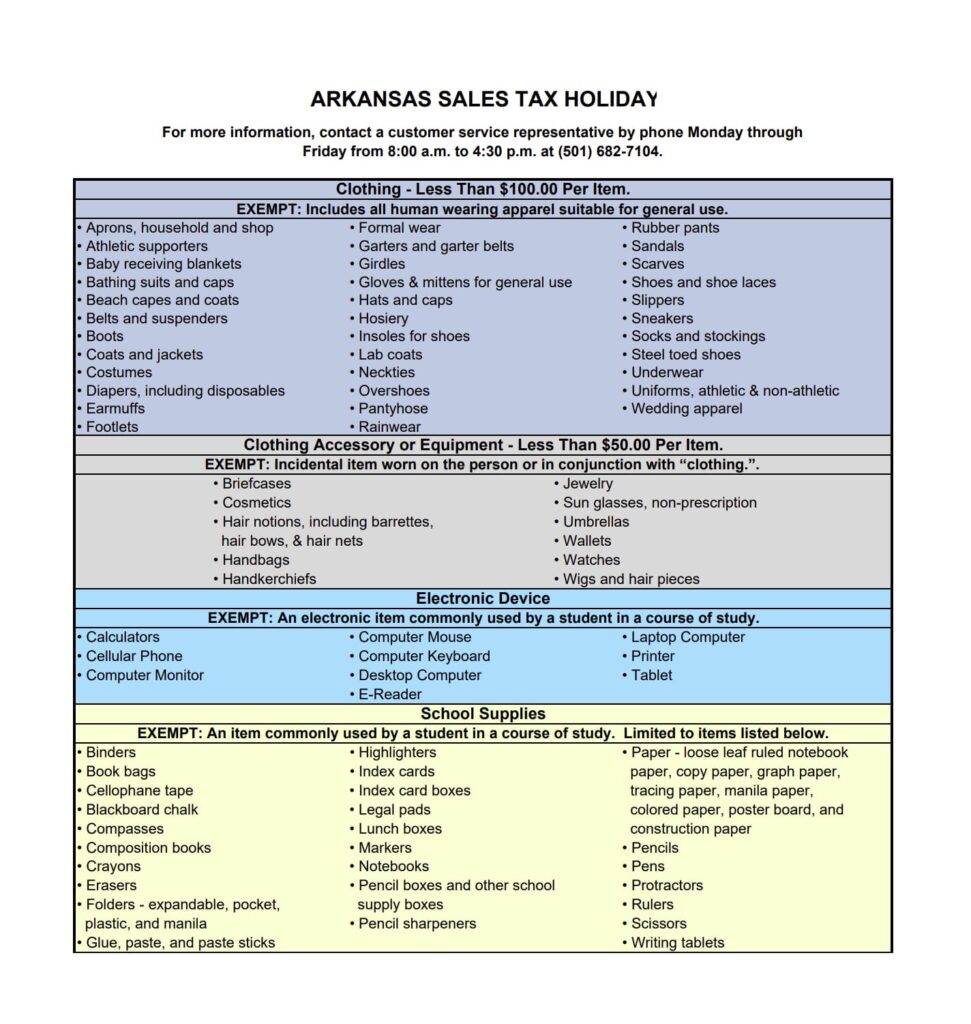

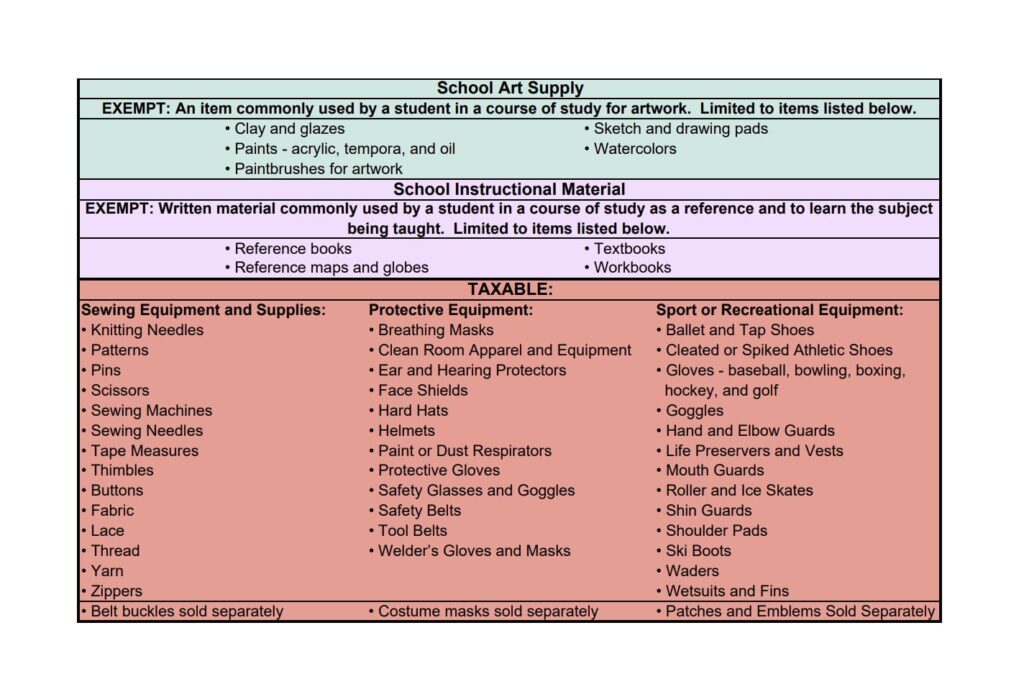

3.) What items qualify as exempt from sales tax for the Sales Tax Holiday?

Clothing and footwear if the sales price is less than one hundred dollars ($100) per item;

Clothing accessories and equipment if the sales price is less than fifty dollars ($50) per item;

School supplies; School art supplies; and School instructional materials.

4.) Where can I find a list of items that are eligible for the Sales Tax Holiday exemption?

http://www.dfa.arkansas.gov/offices/exciseTax/salesanduse/Documents/holidayItemized.pdf

5.) Do I have a limit as to how many qualifying items I can purchase?

The holiday exemption for clothing is limited to single articles with a price of less than one

hundred dollars ($100). Items priced at one hundred dollars ($100) or more are subject to the

full state and local sales tax.

(Example: A customer purchases two (2) shirts at $50 each, a pair of jeans at $75, and a pair of

shoes at $125. No state and local sales tax is due on the two shirts ($50 each for a total of $100)

and the pair of jeans ($75) even though the total cost ($175) exceeds the $100 threshold.

However, the state and local sales tax will be due on the full purchase price ($125) of the shoes

since they exceed the one hundred dollar ($100) threshold.)