By Mary Hightower

U of A System Division of Agriculture

The annual Arkansas Sales Tax Holiday can be a help to families sending children back to school, but a little planning can help shoppers save more and prevent unwelcome surprises at checkout, said extension family and consumer science experts

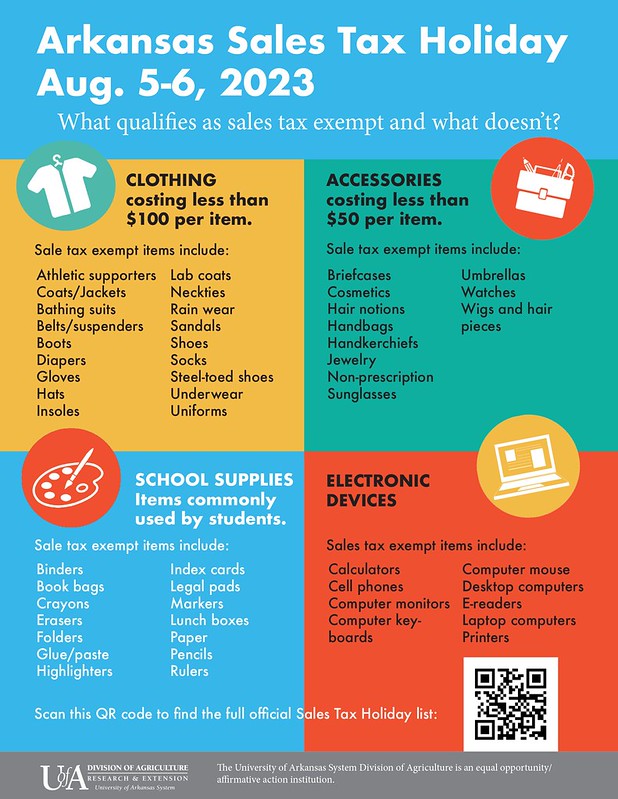

This year’s sales tax holiday begins Saturday, Aug. 5, at 12:01 a.m. and continues through Sunday, Aug. 6, at 11:59 p.m. State and local sales taxes will not be collected on the purchase of certain products. All retailers are required to participate.

“The sales tax holiday covers clothing, footwear, school supplies, art supplies and instructional materials,” said Laura Hendrix, associate professor and extension personal finance expert for the University of Arkansas System Division of Agriculture. “It also includes electronics such as computers, printers, tablets, monitors and cell phones.”

The state Department of Finance and Administration has a list of eligible items online.

Before you go

Before heading out for back-to-school shopping, Hendrix recommends:

- Take inventory of what you need or want to purchase.

- Examine your budget and determine how much to spend.

- Have a plan for how you will pay. “Credit card fees and interest can offset any savings you might have from not paying sales tax,” Hendrix said. “If using credit cards, have a plan to pay them off as soon as possible.”

- Make a shopping list.

- Set a spending limit.

Find practical financial information at the uaexMoney blog.

Tax free — what’s the big deal?

Kris Boulton, Saline County extension staff chair and family and consumer sciences agent for the University of Arkansas System Division of Agriculture, says shoppers need to look at the possible savings.

Arkansas has a 6.5 percent sales tax and depending on where you live, county and city sales taxes will also get tacked on to the bill.

“For ease of calculating let’s round up to 10 percent,” Boulton said. “If you are spending $200 on items for back to school that qualify for the tax-free holiday you would save close to $20. Now what if you are spending $500 your savings is now $50.

“What would you do with an extra $20-$50 in your wallet?” she said. “I can think of some good uses.”

Boulton said that while the Arkansas Sales Tax Holiday is a great resource to use while shopping for Back-to-School supplies, “let’s make sure we all know the items that qualify and the exemptions before we check out and have a rude surprise.

“Although it may be tax-free, it’s still not a bargain if it’s not something that will not be used,” she said.

To learn about extension programs in Arkansas, contact your local Cooperative Extension Service agent or visit www.uaex.uada.edu. Follow us on Twitter and Instagram at @AR_Extension. To learn more about Division of Agriculture research, visit the Arkansas Agricultural Experiment Station website: https://aaes.uada.edu/. Follow us on Twitter at @ArkAgResearch. To learn more about the Division of Agriculture, visit https://uada.edu/. Follow us on Twitter at @AgInArk.

About the Division of Agriculture

The University of Arkansas System Division of Agriculture’s mission is to strengthen agriculture, communities, and families by connecting trusted research to the adoption of best practices. The Division of Agriculture conducts research and extension work within the nation’s historic land grant education system through the Agricultural Experiment Station and the Cooperative Extension Service.

The Division of Agriculture is one of 20 entities within the University of Arkansas System. It has offices in all 75 counties in Arkansas and faculty on five system campuses.

The University of Arkansas System Division of Agriculture offers all its Extension and Research programs to all eligible persons without regard to race, color, sex, gender identity, sexual orientation, national origin, religion, age, disability, marital or veteran status, genetic information, or any other legally protected status, and is an Affirmative Action/Equal Opportunity Employer.